These businesses could both be liable into the ATO or entitled to a refund Each and every year depending upon the balance of the quantity of GST gathered through revenue when compared with any tax credits gained from GST compensated on products and products and services procured from the course of carrying on their organization.

The DTL course could be pursued by students in frequent mode or distance mode. Below described would be the DTL course details:

Australia has transfer pricing policies that should be thought of in which items or companies are purchased or sold amongst Australia and also other international locations.

The admission process for any diploma in taxation law varies for every university. A lot of the institutes prefer admission depending on advantage of 10+two. While there undoubtedly are a number of universities Which may carry out their university-level entrance test. Candidates can check the admission course of action described below:

To get in to the DTL course, candidates should have qualified for their course twelfth exam from the recognized board or university.

Many of the information on this website applies to a selected financial year. This is certainly Plainly marked. You should definitely provide the information for the best year prior to making decisions based upon that information.

The course can be meant for students who would like to get ready for further scientific tests in the sector of taxation and regulation.

To submit an application for help, find "Learn more and use" during the Fiscal Support area below the "Enroll" button. You will be prompted to accomplish an easy software; no other paperwork is necessary.

DTL course opens a wider selection of scope and task potential clients to the candidates who've efficiently finished the DTL course. DTL can be a 1-year certificate level course, so candidates have to study seriously hard to be able to pitch a good income bundle.

The quantity withheld broadly represents the income tax payable on that wage or wage and need to be remitted to the ATO.

The historical origins of the principle are identical with All those of political liberty and consultant authorities—the proper of the citizens

~ Back links will get you to definitely the complete text of your cases and/or to CaseBase summaries, also to commentary in Halsbury's Laws of Australia.

Hall & Wilcox acknowledges the standard Custodians from the land, sea and waters on which we get the job done, click here live and have interaction. We shell out our respects to Elders past, present and emerging.

It is actually levied in a flat fee of ten%. Some provides for example foodstuff, exports, schooling and well being are excluded from GST. All buyers are needed to pay back GST when earning a invest in.

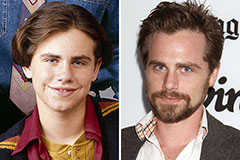

Rider Strong Then & Now!

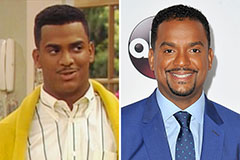

Rider Strong Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!